Accruals and provisions made simple

It’s no secret that, as a conscientious entrepreneur, you should always aim to be as precise as possible when estimating your turnover and budgets. In order to plan for the worst and hope for the best, business owners are required to take caution and set aside money for provisions and accrued expenses in accordance with the generally accepted accounting principles. But what exactly are provisions and accruals and how are they used in accounting?

What are accruals and provisions?

There are two main definitions of the term, ‘accrual’:

- Revenue that has been earned but payment has not been received

- Business expenses that have been incurred but not yet paid

Provisions, meanwhile, are savings that should be put to one side to cover future expenses, potential liabilities, and imminent losses from pending transactions. These expenses should be carefully calculated so that the company doesn’t lose track of its balance. Provisions should also be established for:

- Expenses for maintenance and services that are carried over from the previous year,

- liabilities that need to be restructured,

- warranties,

- pensions

If you’re not used to dealing with provisions and accruals, this section may raise more questions than it answers. Although the uniform commercial code provides information on the circumstances under which you are required to make provisions, there is no definition for accruals or provisions or explanation for how and why they should be calculated.

Accrual accounting is a method of bookkeeping. In this method, income and expenses are allocated to periods to which they apply. The time when they are received or paid is not considered. For example, when an invoice is rendered, its value is added to income immediately, even though it has not been paid. (See USLegal, Inc.)

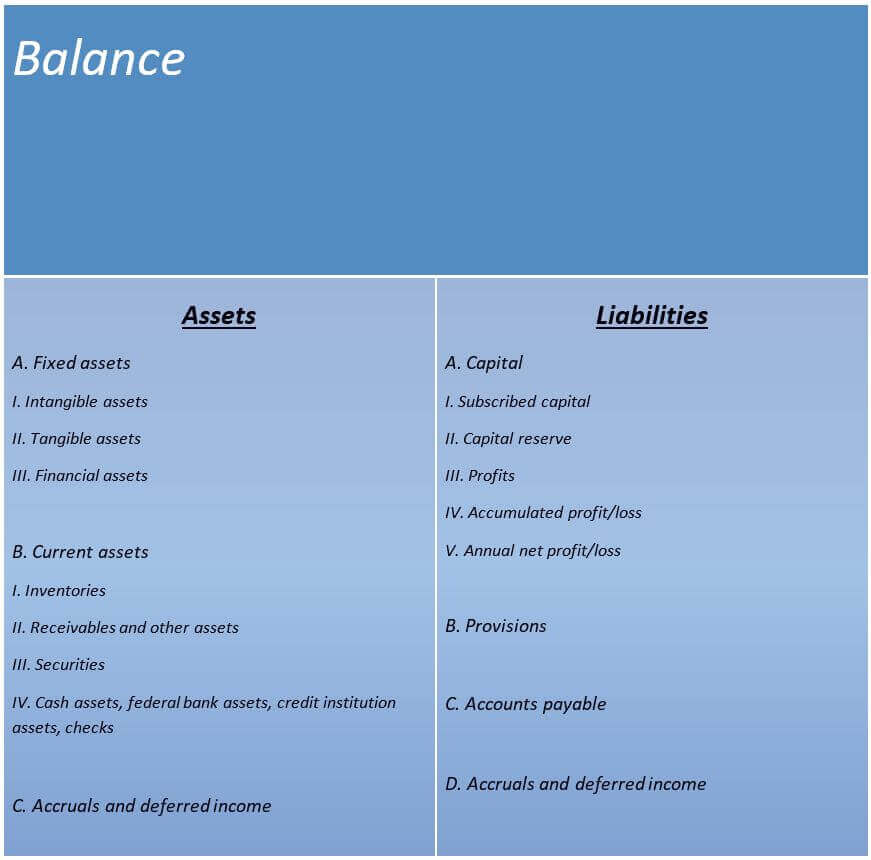

When balancing the books, provisions should be treated as a liability on your balance sheet. Creating provisions ensures your company has enough money to pay future liabilities (e.g. payment of pensions, legal fees, transferals of property, etc.). The company is usually aware of these expenses in advance, but the exact level and cost might not be known until they are calculated later. In other words, provisions are simply financial reserves that a company makes in order to meet future payments and other liabilities.

All liabilities to third parties or imminent losses from ‘pending transactions’ must be included in the balance sheet in the financial statements. Provisions must be reversed on the balance sheet when the liability no longer exists. Find out more about how to record and cancel accruals and provisions here.

Why do we make and reverse provisions?

At the end of the financial year, companies must calculate their total turnover by means of double-entry accounting and communicate the result to the tax office. In addition to your annual tax declaration, the authorities also require you to report your company’s income and expenses within the annual accounts. The rate of income tax you pay is then decided according to the size of the profit margin.

Provisions are also part of the balance sheet, or more specifically, they represent an impairment of equity, meaning they reduce the company’s profit. This is enormously important for your tax balance; if your profit decreases, you will end up paying less tax. Creating and dissolving provisions is therefore logical, even if it is time consuming; without this, you would have to pay more tax at the end of the financial year.

We’ll use pension payments as an example to illustrate the economic benefits of provisions. If you employ staff in your company, the tax office requires a transfer of the resulting income tax and the employee’s share of the pension insurance. The tax burden is then carried by the employee, rather than the company. As the employer, all you have to do is deduct the salary tax rate directly from employees’ salary and pay it to the tax office.

Creating provisions thus helps employers retain a more precise overview equity and profit, as well as contractual obligations that will arise in the future, which will be paid to third parties.

What are the different types of accruals and provisions?

There are two basic types of accruals:

- Accruals that have occurred due to an obligation to a third party (i.e. accrued liabilities, imminent losses)

- Accruals based on an economic obligation to oneself with no specific obligation towards a third party (expense accruals)

While accrued liabilities are fully subject to the payment obligations, companies may only charge expenses for specific items, such as maintenance costs or removal of waste. You may not, however, make provisions for expenses that are not tax deductible.

Obligations towards third parties

If the company has financial obligations to a third party, they are known as debt provisions. These can be subdivided into the following categories: uncertain liabilities, provisions for contingent losses, and goodwill provisions.

Uncertain liabilities

Uncertain liabilities are expenses, the amount or due date of which are not known at the time of accounting. For example, this might include provisions for litigation fees, which the company should anticipate in the event of any legal procedures. Further examples include provisions for taxes and pensions.

Contingency losses

You also need to set aside provisions for imminent losses. This is particularly necessary for pending transactions or business deals in which one or both parties provide their services at a later date.

Impairment provisions

Goodwill is the extra amount you pay when acquiring another business above its estimated value which includes intangible elements like brand recognition and customer base. If a company realizes that the goodwill asset needs to be impaired (brought down to cost price) it can create a provision. Other assets like account receivables and fixed assets can be impaired also, and it is prudent to create a provision, in particular if buildings have recently been damaged.

Expense accruals without benefit obligation

Unlike bad debt provisions, expense accruals are treated as a voluntary commitment. This special type of accrual includes maintenance, salaries, and interest payable.

Deferred maintenance

When it comes to maintenance the following rule applies: if repairs or maintenance measures are to be postponed, the loss of use incurred must be attributed to the period in which it was established. If, for example, a warehouse renovation has been postponed until the following year, you can add the provisions in the balance sheet for the current calendar year. Exercise caution here: Maintenance works must be carried out within the period stated on the balance sheet.

Removal of overburden

An example of deferred maintenance in practice is the removal of overburden. In mining, there is a rule: If you need to reduce individual layers of rock (known as overburden), they must be re-filled into that surface. For this to take place at a later time (i.e. after the balance sheet date), the law requires provisions.

Noting provisions in your balance sheet

Provisions for pensions and similar liabilities

If your employees receive a company pension, you are also required to include this on your balance sheet. However, if the exact amount and the payment period of the pension is impossible to predict while your employees are still working for you, you must estimate these costs and allocate provisions accordingly.

Tax accruals

Your balance sheet must also indicate provisions for taxes and fees that are unknown until the end of the calendar year (e.g. a stock company’s allocation of profits).

Other accruals and provisions

There are still a number of other kinds of provisions, including:

- provisions for salary and commissions,

- provisions for the annual accounts and auditing fees, and

- provisions for litigation risks and redundancy packages.

Click here for important legal disclaimers.