Invoice templates: How Excel, Word, and Co. help with the transmission of payment information

There are countless options for earning money with goods or services but there is only one standard-compliant way to request payment from customers: An invoice. If you’re self-employed or responsible for the finances of a small or medium-sized company, you have to make sure that your orders are followed by the corresponding payment details.

In order for an invoice to be acknowledged by the IRS as proof of an official transaction, simply including a statement of the amount due is, of course, not enough. A number of formalities have to be considered that complicate writing an invoice. The larger the order, the more time-consuming and unclear the process of invoicing becomes if you don’t use any templates. At the same time, you don’t need any special software to overcome the challenges in accounting. An Invoice sample, or customizable template for your invoices, is a fast and easy solution that significantly simplifies your everyday bookkeeping.

What is an invoice template?

Invoice templates are sample invoices that contain all the required components and can be used to map out new invoices. Instead of starting from square one and tediously assembling all of the elements on your own, such a template provides you with a complete example of an invoice with placeholder information that you just have to exchange for the real data. Word and Excel documents are a simple and common solution for invoice templates. You can either create these yourself or download them from the internet - largely for free - and then open them with the selected Microsoft Office application. Invoice templates also exist for text and table programs from other suites, such as OpenOffice or LibreOffice.

Templates for invoices can basically be divided into text-based and tabular solutions: If only a few services need to be billed, then the former is almost always the more suitable choice. The more complex the billable services are, the more likely it is that a tabular invoice template will come in handy. This gives you the advantage of being able to arrange individual prices and the overall price much more clearly. A template can also help you calculate certain values, such as the amount of VAT if the appropriate functions are installed. Since various Office invoice templates can be found for free online, their use is particularly attractive for self-employed individuals and SMEs who only have a limited available budget.

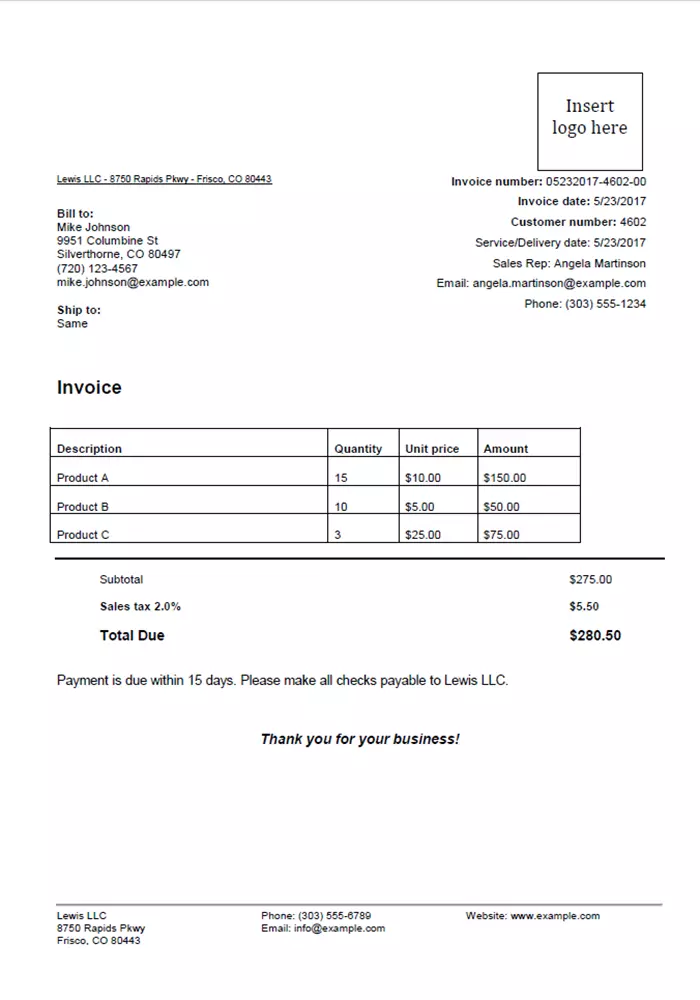

What does an invoice template look like?

Professional invoice samples are characterized by two key aspects: One the one hand, they must be attractive and clear in order for the customers who owe payment to be able to gather all relevant information. On the other hand, a template for invoices must also contain complete content. This is because incomplete data and violations of the formal requirements quickly become problems when being reviewed by the tax office, and can even endanger your tax deductions. For a commercial document to be legally recognized as an invoice in the United States, the following mandatory specifications are made in Title 19 §141.86 of the Code of Federal Regulations. The document must contain the following:

- Merchandise port of entry and final destination (if imported)

- Name and address of both seller and recipient, as well as the date of sale

- Detailed description of the merchandise

- Quantities of merchandise in weights and measures

- Price of each item of merchandise

- Currency type, both according to system (i.e. dollars, euros, etc.) and kind (i.e. gold, silver, paper)

- All additional charges on the merchandise (shipping, insurance, etc.)

- All rebates, drawbacks, and bounties need to be itemized separately

- Country of origin of the merchandise

- All goods and services for the production not included in the invoice price, such as dies, molds, tools, and engineering work (if furnished outside of the USA)

Always check that the information listed above is complete and correct – especially if you’re relying on a template solution for your invoices.

Invoice templates for Word and Excel - How modifications work

To familiarize you with the structure and functionality of the mentioned invoice templates for Excel, Word, and co. we will provide you with the necessary steps to observe during use.

Free Download

Your choice simply depends on which program you would rather work with. If you just want to simply and easily achieve the desired goal - a standard-compliant invoice that contains both the complete and correct information about the provided service as well as the appropriate customer data. Open the downloaded document by double-clicking and then make the following adjustments:

- First and foremost, enter your address information or the company address data in the top left corner. Directly underneath, enter the customer’s address information:

- On the right side, there are three placeholders for the invoice number, the customer number (optional) and the invoice date. You must replace the example numbers here and don’t forget to enter the current date.

- Directly underneath the invoice information, find another placeholder for your own address information as well as other contact details, such as a telephone number or e-mail address. If you don’t offer this type of support, simply delete the respective rows from the invoice template.

- Next comes the subject of the invoice. The wording of which you can determine for yourself. Instead of just using the simple “invoice” in the template, you can also include the invoice number and other agreements or conditions.

- The next line is designated for the body text. This is where you directly address the customer. Typically, at this point, you thank the customer for their purchase of your services or products and formulate a small transition that indicates that the billed costs are listed below. You can also choose to do this at the end, beneath the itemized table.

- After addressing the customer, you list the items (products or services) being billed, which is the most important part of the invoice. For this purpose, you have a table that you can expand or collapse as needed by adding or removing rows. In the columns, enter the description, quantity, and both the individual and total price for each item.

- Under the table, display the total amount due without tax as well as the total invoice amount including tax.

- Finally, you have a text area for additional information to inform the customer about the date on which the service was delivered or the goods were sent. It’s also typical to enter the time frame in which the invoice is due.

- The last part of the sample invoice is the footer. Here, you enter your contact information again and also include the following account or address information required for customers to make a payment:

- Company name (to be used on checks)

- Company address

- Bank account information (if applicable)

Depending on the kind of business you’re doing, you may also need to enter your tax (VAT) identification number. There are exceptions for small businesses, and in general, check with state-specific laws and the laws of any other countries that you may be doing business with to make sure that you’re staying compliant.

Now you can save and print your invoice template. It’s also possible to save the invoice as a PDF file so that you can send it as an e-mail in the future.

Click here for important legal disclaimers.