Legal requirements for cash registers

Do you run a company that generates all, or parts of its revenues, from cash transactions? If yes, then the cash register records are the basis for your company’s taxes. You should therefore carefully document all business transactions to meet the requirements of the IRS (Internal Revenue Service). It is common for business owners who incur a large number of daily cash receipts and expenditures to use an electronic checkout system. A few benefits of using these include:

- Enabling clear, careful reporting

- Facilitating cooperation with the IRS and other financial authorities

- Protecting against theft and fraud (particularly from staff)

- Providing interfaces to professional merchandise management systems

In principle, cash processing systems are subject to the same recording and retention obligations as accounting systems. This article will tell you what you need to consider when using these systems, as well as how to differentiate between different systems.

Accounting guidelines for cash transactions

In the USA, all business owners are required to keep detailed records of their transactions – including cash only businesses. The most popular method of recordkeeping continues to be a cash book, while a detailed file containing records and receipts is also acceptable. For best practice, it is generally recommended to keep both. It is in your interest as a business owner to keep records of your transactions so that you have any evidence required by the IRS in the event of an audit (quite likely if you are operating a cash business, as many business owners understate their cash earnings to avoid paying high tax rates), as well as assisting in business expense reduction claims. Keeping a record of your transactions also extends to your payroll, if you choose to pay your staff in cash.

Companies are required to maintain a cash book, which records all cash receipts and business expenditures.

Cash register models: an overview

While is it imperative to keep records of all your transactions, there is no specific legislation forcing a business owner to keep electronic or paper records. The electronic records you keep (should you choose to do so) must meet basic recordkeeping standards.

Open cash register

An open cash register is a till which is run without technical assistance. Examples of this kind of till include:

- Drawers in a store counter

- Cash cassettes or

- Waiters’ wallets

Since there is no automatic data recording taking place when an open till is being used, it can be a lot of effort to keep track of your records – in comparison to recording them with an electronic checkout system.

In principle, all business transactions must be recorded individually, with a sufficient description containing:

- Transaction content

- Name, company, and business parters’ address

Your cash transactions should be recorded chronologically, numbered consecutively, and should include your states’ sales tax rate. Your bookkeeping is deemed correct if it can provide an expert third party (e.g., the IRS, small claims court etc.) with an overview of recorded transactions within a set period of time.

IRS Publication 463 provides for certain exemptions to the requirement for individual records – this includes expenses that total less than $75, or transportation expenses which may not issue a receipt. Nevertheless, you should still report these expenses in your record books, including these details:

- Date

- Amount

- Place

- Purpose of the expense

In any case, business owners who operate an open cash register are obliged to record the day’s transactions after the close of business. The finished records should correlate with the actual balance of the cash register at all times, in order to be considered competent bookkeeping.

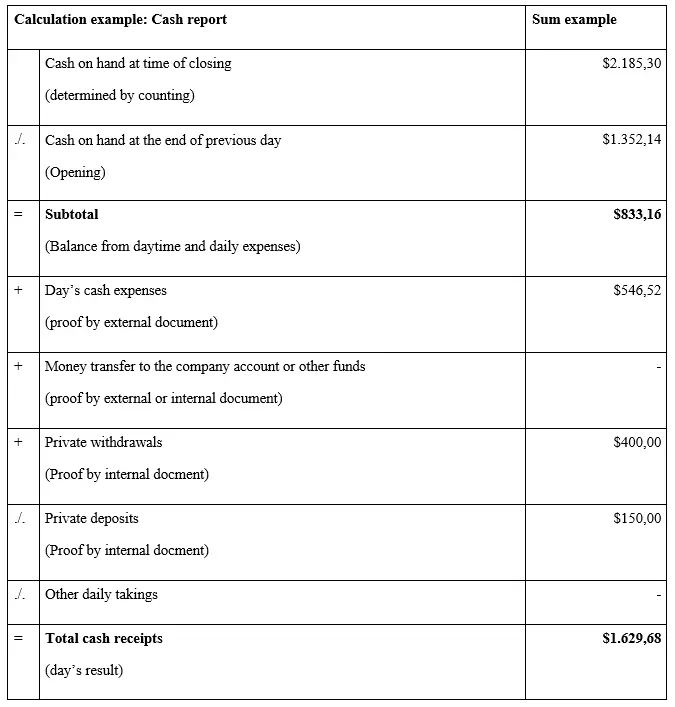

The daily takings should be determined retrogressively in the cash report:

In the commercial sector, the symbol ./. is used instead of (-).

Cash receipts, money transfers, personal withdrawals, as well as private contributions must be documented. If there are no external documents for a transaction (e.g. private contributions) then a self-supporting document or receipt must be drawn up and signed with the date.

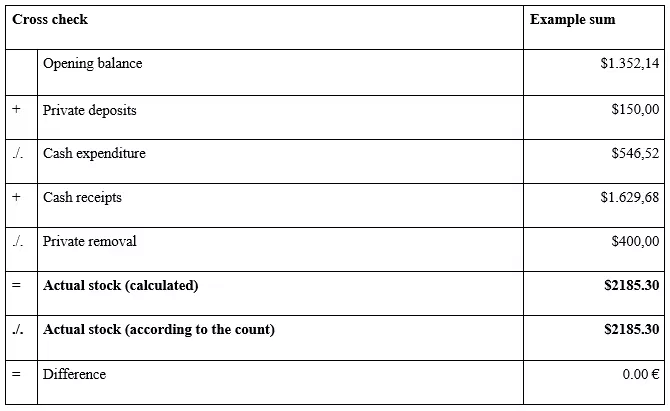

You can work out whether or not the daily result has been determined correctly by means of a counter test. The calculated actual stock should correspond to the actual stock according to the count.

Each cash report is signed and marked with the date and time (probably after the close of business). The daily result determined using the cash report is recorded in the cash book.

Please note: Cash reports and cashbooks created with conventional office software (e.g. Excel) are not always tamper-proof. Accounting software is only deemed to be valid if subsequent amendments are not an option, or are automatically annotated by the program.

Even though open cash register use is permitted in the USA, using an electronic checkout system facilitates proper checkout and bookkeeping considerably.

Electronic checkout systems

Electronic cash collection systems consist of specialized recording equipment which records cash receipts and expenses, and issues receipts. In terms of design and operation, there are two primary electronic cash register systems: cash registers with print drives and PC cash desks.

- Cash registers with print drives: Typical cash registers have one or two print drives. A distinction must be made between mechanical and simple, electronic cash registers.

- Cash registers which print mechanically: Mechanical cash registers usually work with two print drives, issuing a paper document for the customer and a continuous roll which has all the entries for the cash register recorded. The till rolls are not supported electronically.

- Simple electronic cash registers: Simple, electronic cash registers usually have just one print drive. This till roll provides customers with a physical receipt for their purchases. The till roll containing the day’s transactions meant for the business owner is produced and stored electronically. At the end of the business day, the cash data recorded can be output using a one-day total. The records stored in the cash register are then usually deleted.

- PC cash registers and computer-based cash registers: Compared to simple electronic cash registers, PC cash registers offer a wider range of functions in terms of data collection and storage. The use of state-of-the-art PC cash registers is considerably more convenient, thanks to barcode scanners and touch screens. These are also sometimes self-checkouts. Another big advantage over simple electronic cash registers is being able to further process cash data using merchandise management or accounting systems. Restrictions on certain software products need to be observed when using proprietary cash dispensing systems. Computer-based cash registers are available as open and closed systems.

- Open systems: The classic PC cash register is an open system, where software and hardware are purchased independently. Cash register software (standard solution or individual software) is generally based on a standard operating system like Windows or Linux.

- Closed systems: With closed cash registers, hardware and software components are offered as a package by the same manufacturer. Business owners can grow dependent on these, but they are helpful as they benefit from a higher level of data security.

Protection against fraud

Cash register manipulation and fraud is becoming more and more frequent. Typically, the risk for business owners is that customers perform fraudulent returns, or that employees steal from the till. A host of cash register software is available today, providing security elements to protect the business owner from fraudulent activities of this nature. However, there has also been an increase in till tampering by businesses themselves, often in an attempt to evade tax. The EU has taken steps to combat cash register fraud on a federal level, and Canada has also taken steps to legislate against cash register-specific tampering and created legal standards for electronic cash registers. While the US has yet to follow the same legislative steps, all cash registers are subject to the same legal bookkeeping standards, and discrepancies found by an IRS audit will be treated with the same severity as any other record tampering.

Click here for important legal disclaimers.