Correcting or canceling an invoice

If you issue a faulty invoice, it is your job to correct it. This is not just in the interest of the customer, who wants a correct invoice but also the tax office or Internal Revenue System (IRS), who will need to have correct documentation when investigating your tax returns. But what exactly does correcting or canceling an invoice entail? In this article, we will explain what these terms mean and what you should keep in mind when using a correction invoice template.

Powerful Exchange email and the latest versions of your favorite Office apps on any device — get started with our free setup assistance.

Who is allowed to issue correction invoices or cancellation invoices?

Only the service provider, company or merchant who issued the invoice may provide corrections or cancellations to an invoice. A correction by the recipient of goods or services is not permitted and will not be accepted by the tax office.

How long is a correction invoice valid?

In the case of a tax audit, or special sales tax audit, invoices and receipts are the focus of the investigation. Considering how many invoices and receipts a business can accumulate, it is a great achievement for a company to do this with no errors. The reality is that companies often do make mistakes: as a rule, there are some small and occasionally some large errors. The IRS or other investigating authority may ask you enter your tax deductions from the beginning as a result.

A statute called the Administrative Remedies for False Claims (31 USC Chapter 38. §§ 3801 - 3812) covers situations where a claim has been made in error. This statute allows for administrative recoveries by federal agencies. If a person submits a claim that the person knows is false or contains false information, or omits material information, then the agency receiving the claim may impose a penalty of up to $5,000 for each claim. The agency may also recover twice the amount of the claim.

Check your incoming invoices as thoroughly as possible. It would be annoying if atax deduction was denied to you because of an avoidable mistake. Reliable accounting programs help you keep track.

Writing an correction invoice is easy!

Has a customer of yours returned goods to you? Have you noticed an incorrect amount in your invoice, or forgotten to include any other crucial information in it? All you need to do to rectify the situation is write a corrected invoice to your customer! To do this, you need to know what information is crucial when making an invoice.

Required information for an invoice

There is no national legal standard in the USA that states what contents an invoice issued within the US to another customer within the US must include. However, accounting best practice standards dictate that the following information should be present on any invoice issued by a merchant:

The full name and address of both the merchant and the customer.

The business Employer Identification Number (EIN), or if you run a sole proprietorship or LLC, your own Social Security Number.

The customer’s Social Security Number (if provided).

The issue date of the invoice.

The amount due to be paid.

The deadline date for paying the amount due.

The correct invoice number for the invoice.

Accurate description of goods or services provided.

You may be required to include sales tax in your invoice, depending on your state sales tax regulations.

Any pre-arranged discounts applicable.

If one of these details is missing or incorrect, you should issue an invoice correction. If not, you run the risk of having inadequate records when it comes to filing tax returns and may risk not being able to claim back on your sales tax expenses.

There are two things you need to remember when dealing with an invoice correction. Firstly, you must issue the missing or correct information by means of a corrected invoice with a new invoice number. Secondly, your corrected invoice must clearly refer to the previous invoice it is replacing. Do not worry too much about spelling mistakes or typos – generally, if the meaning of your bill is clear, you do not need to make any corrections.

Correction invoice: when your original invoice has not yet been recorded or dispatched.

If the incorrect invoice has not yet been dispatched to the customer or processed by your accounting department, then there is no need to create a correction invoice. All you need to do is start the first invoice again from scratch under the same invoice number and send it to the customer. After all, they have not yet seen the mistake so they need never know it was made in the first place.

However, if the customer has already received the bill, you should issue the corrected one as quickly as possible. It is also best practice to inform the customer that you are issuing them a correction invoice. If the bill has not yet been paid and has not been debited, then you can use a billing correction to correct your mistake. This is a document that corrects the missing or incorrect information and is sent to the customer before they have paid the bill. When issuing a billing correction, you must make sure that the document clearly correlates to the previously issued invoice. To do this, be sure to include the following information:

Name and Address of the company providing the service

Correction of the previous error

Reference to the invoice number and date of origin.

Remember to give any invoice correction or cancellation notice their own invoice number!

Handwritten corrections are also an option in some situations. If your customer comes back to your business with the incorrect invoice, you can correct the error by hand with a note directly on the original invoice. However, you must be sure to sign, date and stamp (if you have a company stamp) the invoice. You will need to make a copy of this corrected invoice for your own records and store it together with the original invoice.

Handwritten corrections sound easy but are also an easy way to create new mistakes. The safest way is to post a correction invoice for the incorrect initial invoice and then create a new, correct invoice which references the first one.

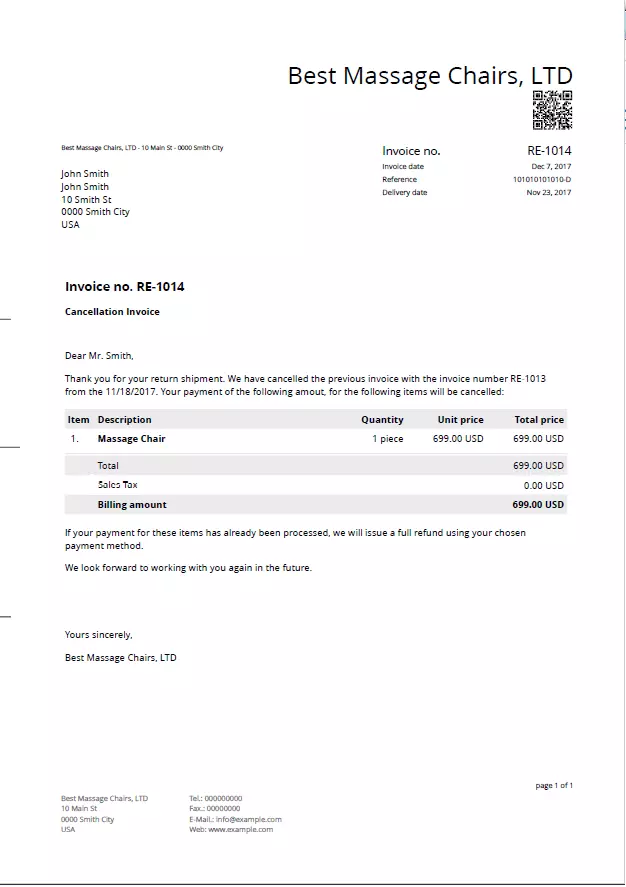

Cancellation invoice: when your invoice has been recorded and dispatched

If the invoice has already been sent, a revised document is no longer sufficient. You will need to proceed in two steps: firstly, you will need to cancel the old invoice and issue a new one. You can cancel the original invoice by creating a cancellation invoice with a negative invoice amount. This means that the original invoice is no longer valid and is canceled when the reversal invoice is posted. Make sure that the cancellation invoice has its own invoice number. Include the following information to ensure that it is assigned to the original invoice: The original invoice number The date of the original invoice Secondly, you will need to create a new proper invoice, with a new invoice number. Be sure to include the original invoice number in the subject line. This will make it easier for the IRS to understand the entire process.

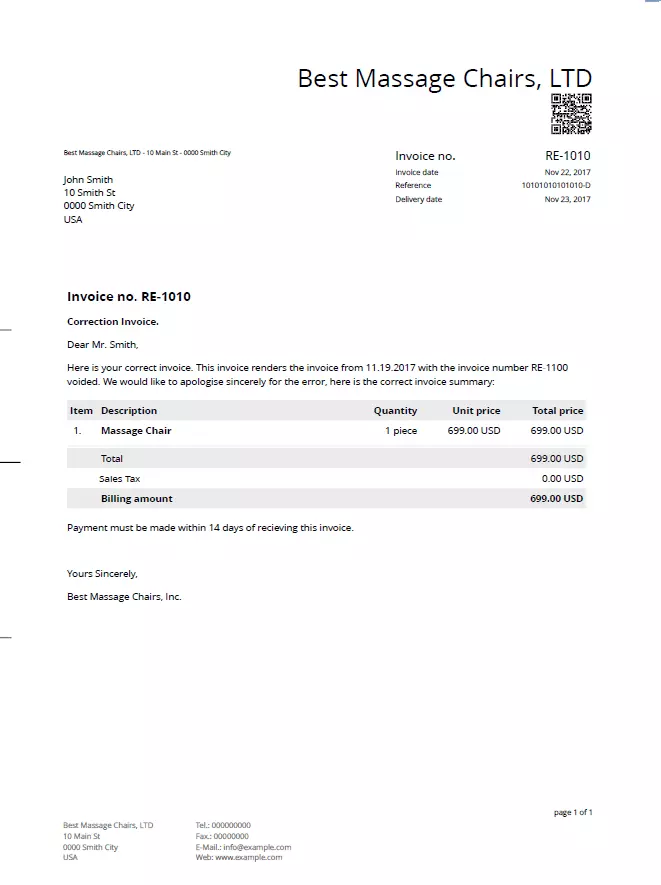

Sample templates: correction and cancellation invoices

Creating bills and invoices is easy with the right software. There are many different templates available for correction and cancellation invoices and they can become confusing. It will help you create a proper invoice like the templates below and forward it directly to your customers.

A template for a proper canceled invoice looks like this:

Click here for important legal disclaimers.