How to create a private invoice using a template

As a private individual, writing an invoice may become necessary in many situations—whether after selling a used item or for a one-time service. In this article, you will learn step by step how to create a proper private invoice and what to consider. We’ve also included a practical Word template for download.

What is a private invoice?

Even as a private individual, issuing an invoice is generally allowed in the United States. If you sell a used personal item, provide a non-professional service, or conduct a financial transaction where the buyer requests a receipt, you may need to create a private invoice. Businesses also sometimes require invoices when purchasing goods or services from private individuals.

However, it is important to understand when issuing an invoice might have tax or legal consequences. In some cases, the IRS may classify your transactions as business activity rather than private sales, potentially requiring business registration and tax reporting. This often happens when sales are made frequently or for profit.

What are the tax regulations for private invoices?

Private individuals can issue invoices, but tax implications depend on the nature and frequency of transactions.

Occasional private sales

- Selling used personal items for less than their original price is not taxable.

- No sales tax collection required for casual, non-business transactions.

Profit from sales

- If an item is sold for more than its purchase price, capital gains tax may apply.

Frequent sales = business

If you regularly sell goods or services, the IRS may classify you as a business, requiring:

- Income reporting

- Possible sales tax collection

- Business registration

Income reporting

- Services exceeding $600 per year from a single client may require 1099-NEC reporting.

- Online platforms (e.g., PayPal, eBay) report transactions over $600 annually via Form 1099-K.

State regulations

- Some states impose sales tax collection requirements, even for private sellers.

When should you, as a private person, issue an invoice?

If you are providing goods or services as a private individual, you can issue an invoice to another private person or even a business. There are no strict legal requirements for private invoices, but they can serve as proof of payment and clarify the terms of a transaction.

- Write perfect emails with optional AI features

- Add credibility to your brand

- Includes domain, spam filter and email forwarding

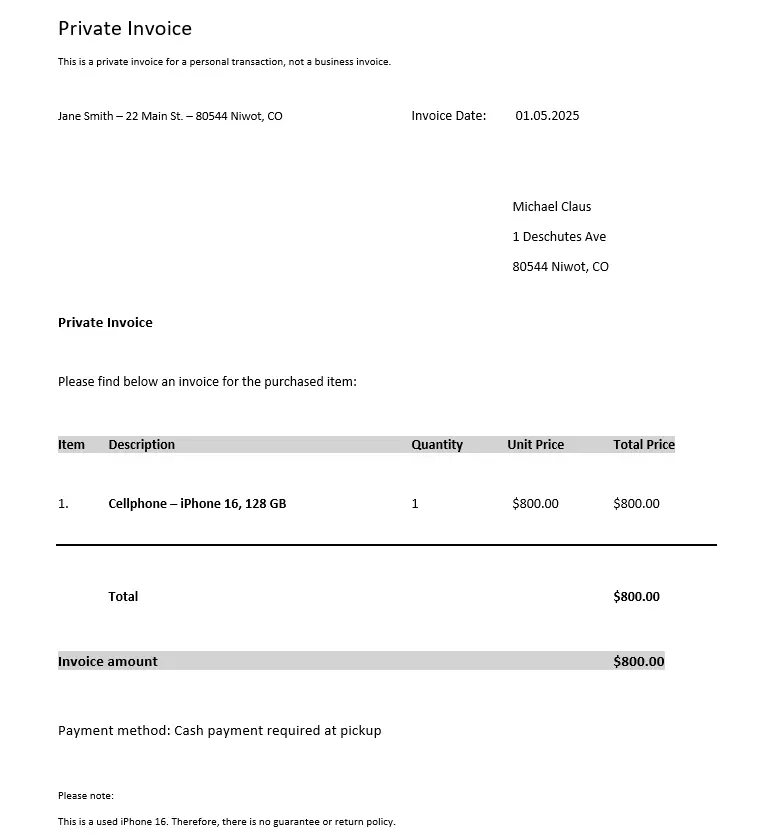

What should a private invoice include?

While there are no formal rules, a well-structured invoice should contain the following:

- Your name and address (issuer)

- Buyer’s name and address (recipient)

- Invoice date and location

- Reason for the invoice (e.g., sale of goods, service rendered)

- Detailed list of goods/services provided, including date of delivery/service and quantity, description, unit price, and total price

- Total amount due

- Payment terms (e.g., “Due immediately” or “Payable within 10 days”)

- Payment method and details (if necessary, include bank details or preferred payment method)

A polite closing, such as a greeting or a thank-you note, can add a professional touch.

If payment is not made in cash, it is advisable to keep a copy of the invoice for your records, especially for tax purposes.

Other details of the legal transaction can also be included on the private invoice. If, for example, a used item being sold has a known defect, it is worth noting that on the private invoice.

“As previously discussed, the phone’s display screen has a few small scratches on the top left.”

What should NOT be included on a private invoice?

- Sales tax: Private individuals are not required to collect sales tax unless they are operating a business.

- Business identifiers: Do not include a business name, tax ID, or other details unless you are officially registered as a business.

To avoid misunderstandings, you may want to include a note such as: “This invoice is for a private transaction and does not include sales tax.”

When does a private sale become a business?

Occasional private sales are generally tax-free, but frequent transactions may be classified as a business by the IRS and state tax authorities. If you regularly sell goods or services with the intent to generate profit, you may need to register as a business, report income, and collect sales tax.

Buying items for resale, selling new or identical products, or conducting sales on a monthly or quarterly basis increases the likelihood of being considered a business. While no strict threshold exists, selling 30 or more items per month, particularly on platforms like eBay, Etsy, or Facebook Marketplace, may attract tax scrutiny.

Maintaining an online store or actively marketing products can further establish business status. If these conditions apply, you may need to register as a sole proprietor or LLC, obtain an EIN, file a Schedule C (Form 1040), and comply with state tax regulations. Consulting a tax professional can help clarify your classification.

Tax considerations for private sales

Even if a sale is not classified as a business transaction, certain tax obligations may still apply. Capital gains tax is due if an item is sold for more than its original purchase price, with short-term gains (owned under a year) taxed as regular income and long-term gains taxed at lower rates.

For online sales, platforms like eBay, PayPal, and Venmo must report transactions exceeding $600 per year to the IRS via Form 1099-K, requiring income reporting even for personal sales. This can cause confusion when selling items at a loss, such as used electronics or furniture.

Some states require sales tax collection, even for occasional sellers, especially if annual sales exceed thresholds like $3,000 per year. Checking with your state’s Department of Revenue ensures compliance.

While occasional personal sales are usually tax-free, frequent sales or profit-making activities may require income reporting and adherence to tax regulations.

Private invoice template to download

Whether using a text editor or invoicing software, issuing an invoice as a private individual is quick and easy. Make sure to include all essential details and add any necessary notes, such as a description of the invoiced item, at the end of the document. Keep a copy of the invoice—either digitally or on paper—for future reference, for example, when filing your tax return.

Please note the legal disclaimer for this article.