How to write a receipt of payment (with template)

Using the right receipt template makes filling out a receipt incredibly simple. But what does a receipt template actually include? And why are receipts necessary at all? We’ll guide you through the process of issuing a receipt and highlight the essential details you must include.

What is a receipt of payment?

A receipt of payment is a document that acknowledges payment for a product or service. It typically includes details such as the date and time of purchase, items purchased, total amount paid, payment method, and business details (such as name and location). If the purchase was made in a physical store rather than online, the store’s address is usually included.

In the United States, there are no federal laws mandating what must appear on a receipt for standard retail transactions. However, electronic and card payment receipts must comply with regulations such as the Fair and Accurate Credit Transactions Act (FACTA), which restricts how much card information can be displayed (e.g., only the last 5 digits of a credit card number can appear, and the expiration date must be omitted).

Unlike some other countries, there is no requirement for receipts to include customer or vendor signatures in most cases. However, businesses may choose to include details like transaction type, tax amount, and currency conversion if applicable.

What is the purpose of a receipt of payment?

Receipts of payment serve several important purposes in the United States, both for businesses and consumers. They act as proof of payment and provide a record of transactions for financial, legal, and tax-related reasons.

- Proof of purchase – Confirms transactions for returns, warranties, and disputes.

- Legal & tax documentation – Essential for business records, tax deductions, and compliance.

- Expense tracking – Helps individuals and businesses manage budgets and reimbursements.

- Fraud prevention – Verifies transactions and assists in charge disputes.

- Regulatory compliance – Ensures businesses follow laws like FACTA on receipt data protection.

What is the difference between a receipt of payment and an invoice?

An invoice is a request for payment issued by a seller to a buyer. It lists:

- Products or services provided

- Prices, taxes, discounts, and total amount due

- Payment terms (e.g., due in 30 days or upon receipt)

- Business contact details (e.g., address, phone, website)

Invoices are typically used for business-to-business (B2B) transactions or for services rendered before payment is received.

A receipt of payment, on the other hand, confirms payment has been made and that a sale is complete. It acts as:

- Proof of purchase for returns, exchanges, or warranties

- A record of what was bought, how much was paid, and the payment method

- A document that includes business details but usually limited customer information

Receipts are most common in business-to-consumer (B2C) transactions and for immediate payments.

The Fair and Accurate Credit Transactions Act (FACTA)

Passed in 2003, the Fair and Accurate Credit Transactions Act (FACTA) introduced consumer protections against identity theft. A key provision of this law applies to receipts and requires:

- Truncation of credit and debit card numbers – No more than the last five digits can appear on a receipt.

- No printing of expiration dates – To prevent fraud, businesses cannot include credit or debit card expiration dates on receipts.

Who has to comply?

All U.S. businesses that provide electronically printed receipts, whether in-store or online, must comply with FACTA, with a few exceptions. Handwritten and manual imprint receipts (carbon copies) are exempt from these requirements. Companies that only issue digital receipts (such as email receipts) must still follow data protection laws but are not bound by FACTA’s printed receipt regulations.

What are the penalties for non-compliance?

Businesses that fail to comply can face fines between $100 and $1,000 per violation. Non-compliance can also damage customer trust and expose businesses to lawsuits for negligence.

How to fill out a receipt of payment correctly

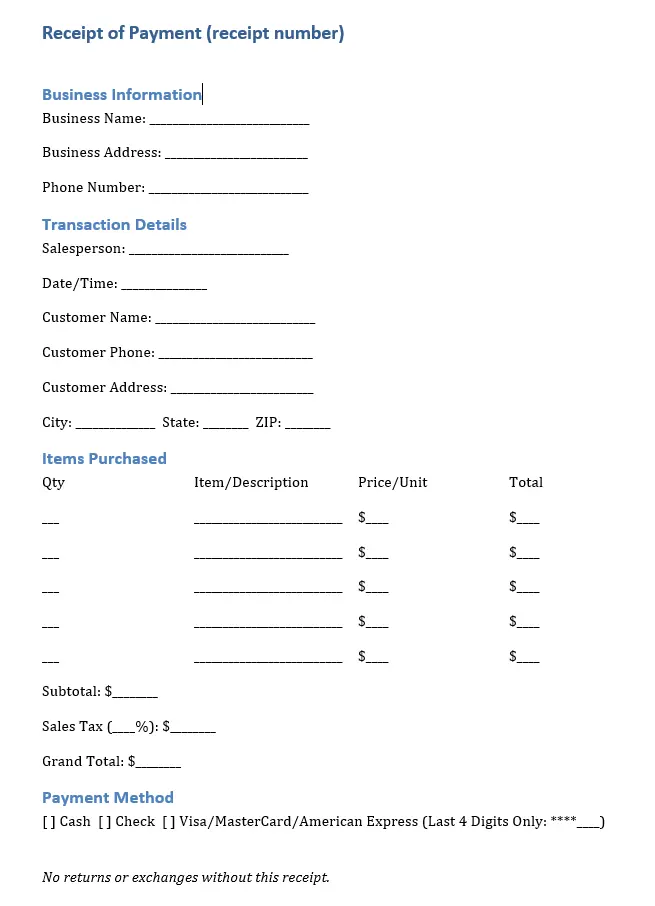

A receipt of payment should typically include the following:

✓ Title: “Receipt of Payment” (optional but recommended)

✓ Transaction date and time

✓ Receipt number (for tracking, but not legally required)

✓ Business name and address

✓ Items purchased or services provided (with description and quantity)

✓ Price per item and total amount paid

✓ Sales tax amount (if applicable)

✓ Payment method (cash, credit card, etc.)

✓ Merchant contact information (phone, email, or website)

Optional but common elements:

- Customer name (only if needed for tracking or tax purposes)

- Last 4 digits of the card number (per FACTA, only the last 5 digits can be displayed, and no expiration date)

- Refund or return policy

You can create a receipt manually, using a receipt book, or generate one digitally with a receipt template on your computer. Accounting software can streamline this process, allowing you to integrate receipt creation with your overall bookkeeping system.

Professional point-of-sale (POS) systems and accounting software can automatically generate receipts of payment while recording transactions, reducing manual work and minimizing errors. The right digital solution can save time, especially for businesses that issue receipts frequently.

Receipt template to download

Please note the legal disclaimer for this article.