Annual financial statements – an overview of the financial year

Is your company a success or failure? Annual financial statements show a company’s financial position over the span of the fiscal year. Establishing your business’s finances is important for you, and to make sure you are complying with tax laws. A precise assessment of your financial situation is also important information for entrepreneurs when undertaking future planning. Here we explain exactly what the accounting term means, and what preparing annual financial statements should look like.

What are annual financial statements?

Annual financial statements are regulated by the Internal Revenue System (IRS) and the U.S. Securities and Exchange Commission (SEC). The aim of creating a financial statement is to compile and process information on a company’s economic situation. There are two goals:

- Information about the results of operations, financial position, and cash flows of an organization

- This information is used to estimate the liquidity, funding, and debt position of an entity, and is the basis for a number of liquidity ratios

Annual financial statements are required for the public (if you have a publicly traded company) and for taxation authorities, as they may use your financial statements in their tax assessments. Annual financial statements show how high a company’s profits or losses are and can be then used to calculate income tax.

The primary aim of a financial statement for publicly traded companies, however, is to inform shareholders and the public. Annual financial statements are filed as part of your company’s annual report. Financial statements for a public company must be made available to anyone who requests access, and must be filed quarterly with the SEC. You are also required to file an annual report with the Secretary of State in each state in which you operate. Interested parties, like shareholders or potential investors, can use this information to assess how secure their investments are, or would be, in the company.

Public company owners are required to file annual financial reports in the state where their business was formed, and again in every state in which their company operates. Deadlines are usually based around the date that your company was created; the filing requirement begins a year after formation and continues until the company is dissolved. However, there are some states that set their own annual deadlines, and things can quickly become confusing if you are a business owner operating in numerous states. Consulting a tax professional is the best way to ensure that you are legally complying with all your state deadlines.

Annual financial statements are also important for internal communication. An overview of a company’s financial situation means that there is accountability. Management is obliged to prove how and to what extent capital has been used. The different groups involved in a company (shareholders, investors, etc.) can measure the success or failure of their management by this. That is why the detailed listing of all items in the balance sheet and income statement (the two main components of annual financial statements) is so important. The result isn’t the only thing that counts: a bad business appraisal does not necessarily mean that those responsible have done a bad job. Only an in depth look at the exact figures can reveal where the errors lie.

Who needs to prepare annual financial statements?

As previously mentioned, all publicly traded companies are required to prepare and publish annual reports including financial statements. Despite there being no legal obligations for private companies or sole traders to do so, it is often helpful for their own assessments to prepare financial statements.

The easiest bookkeeping methods for most sole traders and partnerships is preparing a single income statement rather than undergoing the hassle of double-entry accounts. Single income statements are sufficient to submit to the tax authorities in their annual returns.

As well as publicly traded companies, LLCs and corporations are required to file annual financial reports to their Secretary of State. It is important to find out what the state regulations are in each state your business operates, as many of these have different rules.

Company’s size | Accounting obligations | Public disclosure requirement |

Sole proprietorship | - Balance sheet - Statement of financial performance - Statement of cash flow | No |

General partnership | - Income statement - Cash flow - Capital account | No |

Limited partnership | - Income statement - Cash flow - Capital account | No |

Limited liability partnership | - Income statement - Cash flow - Capital account | No |

Corporation | - Balance sheet - Income statement - Cash flow statement - Statement of changes in owner or stockholder equity | If publicly traded or required by your Secretary of State, yes |

- Balance sheet - Income statement - Cash flow statement - Statement of changes in owner or stockholder equity | If publicly traded or required by your Secretary of State, yes |

Annual reports and financial statements can usually be filed online, saving you time and money.

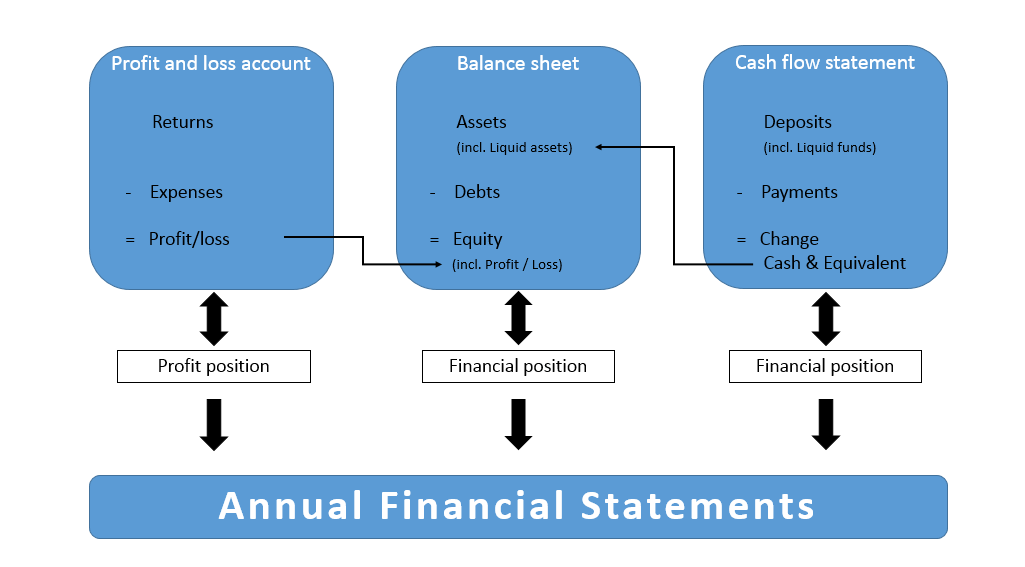

Components of an annual financial statement

Annual financial statements should be a precise statement of a company’s finances from the past year. Therefore, the two most important main components are the income statement and the balance sheet. This gives interested third parties the opportunity to obtain information about your financial situation and the development of a company (by comparing several financial statements). In addition to these two important components, there are other documents you will likely need to include with your annual report.

Profit and loss account

Your profit and loss account reveals the economic successes or failures of your company, which is why this statement is also called an income statement. In this cost estimate, you offset income against expenses but list all items in detail. In this way, it is easy for third parties to trace which components have led to profit or loss.

Profit and loss accounts should be prepared according to specific methods. Read our article about profit and loss accounts to find out what you need to be aware of.

Balance sheet

The balance sheet lays out the ending balances in a company's asset, liability, and equity accounts as of the date stated on the report. As such, this statement has both an asset and a liability element. The basis for the balance sheet is the trial balance where all ledger accounts are listed according to closing value. Finally, all quantity information is omitted from the balance sheet and only monetary value plays a role. At the end, a balanced equation must be clear, both sides must have the same value i.e. total assets must equal the total liabilities plus the equity. Equity is composed of capital, additional paid-in capital, and retained earnings (profit from previous years).

We have summarized a guide on everything you need to know to prepare a balance sheet.

Appendix

While not a legal obligation, it is common practice for companies that submit annual financial statements to include additional notes. These notes provide further information on the contents of the balance sheet and income statement, fulfilling four functions:

- Interpretation: These notes provide information that explains the balance sheet and income statement in more detail. Results can be interpreted better when the methods used are explained clearly.

- Clarity: To ensure that the results of the balance sheet and income statement are not misunderstood, additional notes can provide clarifying information. A misunderstanding can occur if an inaccurate financial picture is painted, and following clear guidelines can ensure that there is no confusion. This applies to both positive and negative circumstances.

- Credit: To keep the balance sheet and income statement clear, certain data is sometimes removed or omitted. In order to make sure that interested parties can still obtain an accurate, comprehensive picture of the current economic climate within a company, transferring missing information to the appendix notes is an option.

- Additions: Additional notes can also be used if information from the balance sheet and income statement is insufficient to present an accurate picture. Disclosures relating to items not eligible for inclusion in the balance sheet may be moved to the appendix notes.

Balance sheet policies can also be used to present the company. Legislation only has minimum information requirements, but in no way does it prohibit additional information. Any statement that better explains the financial situation of a company is welcomed by the authorities – provided that the principles of clarity and coherence are adhered to.

Although there is no mandatory sequence of entries, certain structures have become established in financial accounting. Your approach to the balance sheet and income statement should start with general information. Which methods did you use? This is followed by explanations of the annual financial statement’s two main components. Entries should, however, appear in the same sequence on both the balance sheet and the income statement. You can then add any other information to your notes that is not included in the first two categories.

Review of operations

Oftentimes, companies will include a management report with their annual financial statements to help better assess a company’s future development. This management report puts words behind the numbers provided in the income statement and balance sheet. The function of an operation review is ultimately to provide information and accountability.

In contrast to the financial statements, which focuses more on presenting data and figures, management reports are used for analysis and commentary. If your annual report is being published and distributed to shareholders, aspects of the operations review will likely be touched on in the initial letter from the Chief Executive Officer (CEO). Management reports often include the following aspects:

- Economic report: This section is intended to present the course of business taken during the financial year and the company’s position. Management can use this as an opportunity to express their view of the year’s financial results and the situation on the reporting date. The market share, as well as investment products, pending transactions or productivity are taken into account.

- Risk and forecast report: This part of the report presents the expected development of the company – but not without substantiating it first with underlying assumptions. Planned initiatives will also be addressed. Third parties should be able to assess the plausibility of the information and comments. The forecast should cover at least one year.

- Report on financial risks: The report provides information on risk management measures. Potential financial risks for the company are also discussed here.

- Research and development plans: The information in this part of the operations report provides an overview of the company’s research and development activities. Although this area can be represented by the expenses incurred, the expected profit can only be estimated. Planned research initiatives in the future are also included in this section of the report.

- Branch office report: If your company has multiple branches or offices around the country or abroad, it may be worth including their information if they are organized separately from head office. Including this in a report can provide an insight into the geographical spread of the company and might include information about investments and employee numbers in these branches.

- Remuneration report: This report is intended to provide transparency for shareholders and as a result, is only relevant for publicly traded companies making this information public. It provides information on the remuneration of the Executive Board, the Supervisory Board, the Advisory Board, and their former members.

- Report on a takeover situation: Publicly listed companies and partnerships limited by shares must provide potential bidders with an overview of any possible takeover. Obstacles like restrictions on voting rights and powers of the Board of Management are also addressed.

- Internal control and risk management: This section clarifies which methods are used to safeguard accounting. The report is only relevant for corporations.

- Directors, Executive Officers and Corporate Governance: The text is intended to provide an insight into corporate management practices. This consists of a description of, information on practices that go beyond the legal requirements and – in the case of public limited companies – information on diversity in bodies. In contrast to the rest of the management report, there is no need to audit a corporate governance statement. The auditor just has a critical-reading obligation to check the document for inconsistencies.

Statement of retained earnings

This statement, also known internationally as the statement of changes in equity, is an integral part of the annual financial statements for capital market-oriented corporations that are not required to prepare consolidated financial statements. The aim of the statement of retained earnings is to reflect changes in equity – and in all its components – between two balance sheet dates. All changes (i.e., not just successes) in the company should be listed. Statements of retained earnings uses the contents of the income statement to provide context for the balance sheet. Statements of retained earnings are required under the U.S Generally Accepted Accounting Principals (U.S GAAP) in cases when comparative balance sheets and income statements are provided together. While there is no regulation under commercial law for how this document should be structured, they generally include the following items:

- Issued capital

- Capital reserve

- Retained earnings

- Revaluation reserves

- Retained earnings

- Annual profit

This information is accumulated on the basis of values from the previous years’ key date and shows all events from there that have led to changes. At the end, the figures of the last key date should be displayed. This results in a clear table that includes all changes in equity.

Cash flow statement

A complete financial statement also includes a cash flow statement. Even if you, as an entrepreneur, are not required to prepare a cash flow statement, it is still recommended that you do so: the aim of the calculation is to show the cash flows between two reporting dates. For example, a cash flow statement provides information on the movements of all funds affecting liquidity and provides more information on the flow of money within a company than the annual financial statements with the balance sheet, income statement and notes can.

More information on the cash flow statement can be found in this article on cash flow statements.

The cash flow statement is divided into three totals:

- Cash flow from operating activities

- Cash flow from investing activities

- Cash flow from financing activities

The cash flow can be calculated using two different methods, the direct method and the indirect method.

The direct method

The original or direct method of cash inflows and outflows is based on the cash flows directly in the respective business transactions. This means that you can calculate the cash flow statement directly from all incoming and outgoing payments – the balance results in the cash flow statement. In this case, the items are marked according to their purpose:

1. | Deposits from customers | |

2. | - | Payments to suppliers and employees |

3. | + | Other receipts (excluding investment or financing activities) |

4. | - | Other payments (excluding investing and financing activities) |

5. | + | Proceeds from extra items |

6. | - | Payments from extra items |

7. | ± | Income tax payments |

8. | = | Cash flow from operating activities |

9. | + | Proceeds from disposals of intangible assets |

10. | - | Payments for investments in fixed assets |

11. | + | Proceeds from disposals of property, plant and equipment |

12. | - | Payments for investments in property, plant and equipment |

13. | + | Proceeds from financial assets disposals |

14. | - | Payments for investments in financial assets |

15. | + | Proceeds from disposals from the scope of consolidation |

16. | - | Proceeds from additions to the scope of consolidation |

17. | + | Proceeds from financial investments as part of short-term financial management |

18. | - | Payments due to financial investments as part of short-term financial disposition |

19. | + | Proceeds from extraordinary items |

20. | - | Payments from extraordinary items |

21. | + | Interest received |

22. | + | Dividends received |

23. | = | Cash flow from investing activities |

24. | + | Proceeds from capital contributions from shareholders of the parent company |

25. | + | Proceeds from equity contributions from other shareholders |

26. | - | Payments from equity reductions to shareholders of the parent company |

27. | - | Payments from equity reductions to other shareholders |

28. | + | Proceeds from the issue of bonds and raising of (financial) loans |

29. | - | Repayment of bonds and (financial) loans |

30. | + | Proceeds from grants received |

31. | + | Proceeds from extra items |

32. | - | Payments from extra items |

33. | - | Interest paid |

34. | - | Dividends paid to shareholders of the parent company |

35. | - | Dividends paid to other shareholders |

36. | = | Cash flow from financing activities |

37. | Cash-effective changes in cash and cash equivalents (this is the sum of totals 8, 23. and 36.) | |

38. | ± | Effect of exchange rate and valuation changes on cash and cash equivalents |

39. | ± | Changes in cash and cash equivalents due to changes in the scope of consolidation |

40. | + | Cash and cash equivalents at the beginning of the period |

41. | = | Cash and cash equivalents at the end of the period |

The indirect method

Using this method, the information for the cash flow statement is determined from the annual financial statements. To do this, you first adjust the income statement for all non-cash business transactions (like depreciation). Only the first part of the cash flow statement (cash flow from operating activities) changes as a result: cash flows from investing and financing activities are generally determined directly.

1. | Net profit/loss for the period (consolidated net profit/loss including minority interests) | |

2. | ± | Depreciation/writeups of fixed assets |

3. | ± | Increase/decrease in provisions |

4. | - | Other payments (excluding investing and financing activities) |

5. | + | Proceeds from extra items |

6. | - | Payments from extra items |

7. | ± | Income tax payments |

8. | = | Cash flow from operating activities |

Both methods come to the same result. However, since it is difficult to determine the cash flow from operating activities and cannot be determined by third parties, most companies choose the direct method with direct determination of areas 2 and 3.

Segment reporting

The aim of segment reporting is to provide information on the individual business segments of a company. This enables third parties to gain a better insight into the areas and therefore better assess the opportunities and risks of investment than is possible with the data from the income statement and balance sheet alone. Complete segment reporting is only mandatory for publicly traded companies that are required to prepare financial statements.

The individual segments result from the internal organizational structure of the company. If there are different internal segments, the company has to choose the one that best represents the opportunities and risks. The International Financial Reporting Standards (IFRS) 8 require an entity whose debt or equity securities are publicly traded to disclose information to enable users of its financial statements to evaluate the nature and financial effects of the different business activities in which it engages and the different economic environments in which it operates. IFRS 8 requires judgement in its application. Management should consider the key principle as it determines its segment disclosures rather than relying on a set of rules. The key concept is that the entity should provide information used by management that will allow users to understand the entity’s main activities, where those activities are located and how well those activities are performing.

Segments whose opportunities and risks behave homogenously towards each other can be combined. The reason for this is that it is recommended to only list 10 segments in total in the report. The aim is to keep segment reporting as clear as possible and still provide a comprehensive picture of the company. It is easy to differentiate between a primary and secondary reporting format, since segments are created once by a business sector and once regionally. The accrual/deferral type, which better represents the opportunities and risks, is automatically assigned to the primary reporting format. If this cannot be clearly determined, business segments are generally primary and regions are generally secondary segments.

Disclosure requirements

- General information

- Information about the reportable segment; profit or loss, revenue, expenses, assets, liabilities, and the basis of measurement

- Reconciliations

- Entity-wide disclosures

Presentation format

While there is no set way to present your segment report, one of the most popular ways is in tabular form. You don’t just enter the current values, but also the previous year’s values, so that third parties can get the most comprehensive impression possible. Following the principle of consistency, you should choose the same display format in each period. Since you have to accommodate for both report formats, choose either the single-level or combinatorial type.

In single level segmentation, the primary and secondary report formats are listed one below the other:

Revenues in USD million | Further information | |

Business area | ||

A | 300 | … |

B | 600 | … |

C | 100 | … |

Total | 1000 | … |

Region | ||

USA | 700 | … |

France | 150 | … |

UK | 150 | … |

Total | 1000 | … |

The combinatorial display form, on the other hand, links the two segmentations and displays them in a matrix:

Business area/region | A | B | B | Total |

USA | 200 | 400 | 100 | 700 |

France | 50 | 100 | 0 | 150 |

UK | 50 | 100 | 0 | 150 |

Total | 300 | 600 | 100 | 1000 |

What do annual financial statements look like?

An annual financial statement always consists of at least a balance sheet and a profit and loss statement. In addition, the Generally Accepted Accounting Principles (GAAP) should be followed. These are generally accepted rules that apply not only when you are preparing annual financial statements, but also in general accounting. It must be possible for an independent third party to understand the information provided.

Pay attention to these rules when preparing your annual financial statements:

- Reliable, verifiable, and objective: For example, showing land at its original cost of $10,000 (when it was purchased 50 years ago) is considered to be more reliable, verifiable, and objective than showing it at its current market value of $250,000. Eight different accountants will wholly agree that the original cost of the land was $10,000 – they can read the offer and acceptance for $10,000, see a transfer tax based on $10,000, and review documents that confirm the cost was $10,000. If you ask the same eight accountants to give you the land's current value, you will likely receive eight different estimates. Because the current value amount is less reliable, less verifiable, and less objective than the original cost, the original cost is used.

- Consistency: You use consistency to make it easier to compare the financial statements of different periods. To do this, you use the same terms and schemas each year when creating financial statements. The type, value and quantity determination for individual items should also remain the same year after year.

- Comparability: Investors, lenders, and other users of financial statements expect that financial statements of one company can be compared to the financial statements of another company in the same industry.

Annual financial statements: an example

Miller Corporation

Miller City

Annual financial statements for the financial year from 01.01.2018 to 12.31.2018

Balance

Assets

31.12.2018 | 31.12.2017 | |

Current assets | ||

Cash | ||

Accounts receivable | ||

Inventory | ||

Total current assets | ||

Fixed [long-term) assets | ||

Property, plant, and equipment | ||

Intangible assets | ||

Total fixed assets | ||

Total assets |

Liabilities and owner’s equity

Current liabilities | ||

Accounts payable | ||

| ||

| ||

| ||

| ||

| ||

B. Accruals | ||

C. Liabilities and shareholder’s equity | ||

Total equity and liabilities |

Profit and loss account

31.12.2018 | 31.12.2017 | |

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

|

The above example does not claim to be a complete template. Depending on the size and legal structure of your company and the information you are able to provide for an accurate assessment of your company, your annual financial statements may look different.

Click here for important legal disclaimers.