Net Present Value: This is how you determine your investment’s net present value

A good investment is any investment that yields returns. An investment’s profitability is determined by the expected profit’s relationship to the original invested amount. But how can future cash flows be assessed from the vantage point of the present?

In this context, the finance industry uses the term “time value of money” (TVM). What this means is that a deposit made today is more valuable than a future deposit of the same amount. The reason for this is that money that you have today can be invested in the capital market at a profit.

Let’s say you allocate 10,000 dollars for two years and then receive the full amount back. In this case you’d suffer a loss, and at that, one amounting to the interest earned on a two-year investment. In this context, this is referred to as “opportunity costs”. You should also consider these when planning investments. One way to do this would be to calculate the net present value.

The present value of future payments is determined through discounting. This allows to you reduce the amount by the interest income that an alternative investment in the same amount would generate over the respective period.

We’ll demonstrate the calculation step by step using a practical example.

What is Net Present Value?

The net present value (NPV) is an indicator for dynamic investment calculation. Investors use the NPV to determine the value of future deposits and payouts at the present time. In this way funds from different calculation periods for comparable and different investment opportunities can be weighed against each other with respect to their profitability.

The investment calculation is used within the framework of investment planning and includes various calculation methods that enable a rational assessment of investment projects. In economics, we differentiate between static and dynamic investment calculations. While static methods are oriented toward a typical average year for investment, dynamic methods take into account the entire investment period. As a result, they also capture fluctuations in the deposits and payouts generated by the investment over the course of the various observation periods. The calculation of the net present value is one of the dynamic investment calculation methods.

Net present values are determined and assessed within the framework of the net present value method.

The net present value is the sum of all an investment’s discounted deposits and payouts at the present time. It is also known in English as “net present worth”, or NPW.

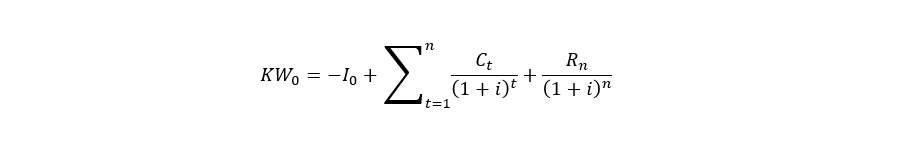

How is the Net Present Value calculated?

The meaning of the listed operands can be found in the following table.

I0 | Investment at starting point (t = 0) |

n | Duration in years |

t | Time interval |

Ct | Cashflow |

Et | Deposits at time t |

At | Payout at time t |

i | Discount interest rate in % |

Rn | Residual value |

NPV0 | Net present value |

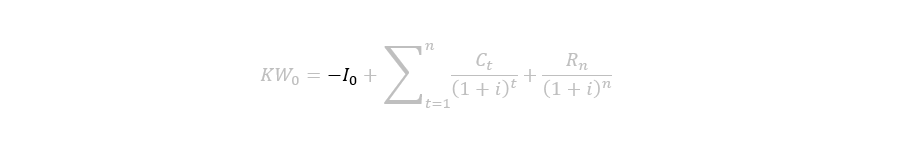

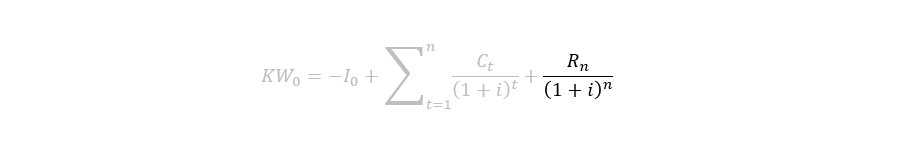

Sometimes you’ll find an alternative notation in relevant literature on the subject:

Both formulas produce the same result.

The method for calculating the net present value using the given formula looks very complex at first glance, however, it can be broken down into seven simple substeps.

In order to determine an investment’s net present value, you need to proceed as follows:

- Determine the investment amount.

- Determine the investment period.

- Calculate the cash flows for the respective time intervals.

- Establish the discount interest rate.

- Determine the residual value of your investment.

- Determine the net present value of each investment interval.

- Determine the net present value of your investment.

We’ll demonstrate the calculation for you using an example.

Let’s say you’re operating a carpenter’s workshop and plan to invest in a new extraction system that includes a briquetting press. The idea: The new machine will collect wood dust and chips, and press them into space-saving briquettes which can then be sold profitably. However, the corresponding equipment is expensive. To be able to estimate whether the investment is worthwhile, you’ll need to calculate its net present value.

Step 1: Determine the investment amount

In the first step, determine the costs that you must pay at the beginning of the investment by consolidating all payments at the starting point t = 0.

The investment amount takes into account all costs affecting payment that are associated with the investment and that arise at the current time. For example:

- Acquisition costs for machines, systems, vehicles and operating equipment

- Costs for personnel recruitment or training

- Service costs (e.g. advertising)

For the payout, the investment sum in its entire amount is factored into the calculation of the net present value as a negative amount.

For our calculation example, we assume that a clean-air extraction system with a briquetting press in the required size costs about 26,000 dollars. In addition, there are costs of 3,000 dollars for the installation of the system and 1,000 dollars for instructing employees on how to use the new machine. The entire sum of the investment thus amounts to 30,000 dollars, which are due at the beginning of the investment period.

Step 2: Establish the investment period

The net present value is determined within the framework of a dynamic investment calculation method. Here you determine the investment period (n) in time intervals (t) for which you determine and discount separate cash flows. The net present value thus takes into consideration both fluctuations in the deposits and payouts that result from the investment, and those developments in the capital market that effect the rate applied to the cash flow discounting.

To begin with, estimate the period for the planned investment. This is the time span over which an investment generates deposits and payouts. An investment period is usually measured in years. In the case of discounting, it thus occurs at intervals of once per year.

In terms of our example, the manufacturer of the extraction system states that the service life of the system is 20 years. However, we plan to replace the machine after 4 years with a more modern model and resell the old system at the highest possible price. Therefore, we assume an investment period of four years (n = 4). This corresponds to four time intervals of one year, for which separate cash flows must each be determined and discounted.

Step 3: Calculate the cash flows

For our investment example, we calculate the cash flows for four years while taking into account all expected deposits and payouts.

A wholesaler of green fuels offers to purchase the briquettes. Each year generates deposits of 10,000 dollars. However, use of the extraction system also entails electricity and maintenance costs. According to the manufacturer, these amount to 4,000 dollars per year. In addition, costs of 2,000 dollars are incurred every two years due to the replacement of worn-down parts.

This results in the following cash flows for the investment period’s four time intervals.

| Deposit | Payout | Deposit surplus | |

|---|---|---|---|

| C1 | $10,000 | $4,000 | $6,000 |

| C2 | $10,000 | $6,000 | $4,000 |

| C3 | $10,000 | $4,000 | $6,000 |

| C4 | $10,000 | $6,000 | $4,000 |

Step 5: Determine the residual value

An investment’s residual value corresponds to the liquidation proceeds at the end of the investment period. One example of this can be seen in the sale of machines and vehicles. If costs are incurred after the end of the investment period – let’s say disposal costs, for example – this is referred to as “negative liquidation proceeds”. Within the framework of the net present value calculation, the residual value is also discounted.

The residual value is only to be determined when necessary. This is because not every investment is connected with a liquidation process. Training, for example, constitutes an investment in employee qualifications that yields no residual value.

In our calculation example, on the other hand, we assume that the clean-air extraction system with the briquetting press can be sold for half of the new price after four years. The residual value thus amounts to 13,000 dollars.

Step 4: Set the discount interest rate

Cash flows are discounted during the investment period using a rate specifically established for this purpose. This is the main operand for calculating net present value.

Determining how high of a discount interest rate should be applied involves taking into account the opportunity cost principle and deriving the best alternative investment opportunity from the interest rate. You also take inflation into consideration.

In contrast to static methods for calculating investments, the net present value method also takes into account the term structure of interest rates and compound interest. As needed, a different discount interest rate can be applied in each time interval.

In our example, we assume that you have the option to invest the investment sum (30,000 dollars) risk-free on the capital market at an interest rate of 0.2 percent. This is why we use this interest rate as a discount rate.

Step 6: Determine present value

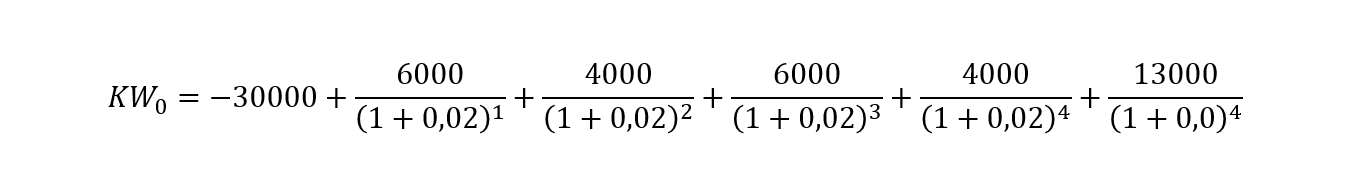

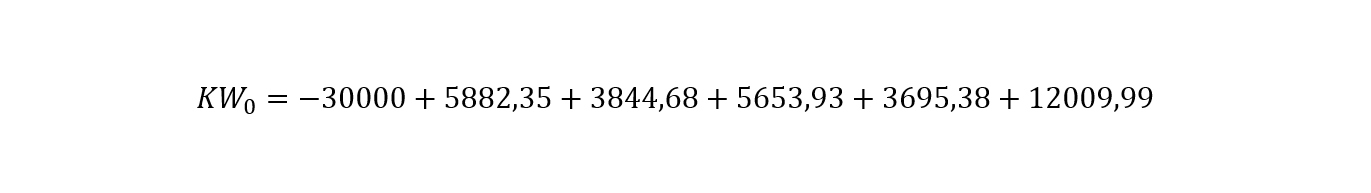

Step 7: Determine the net present value

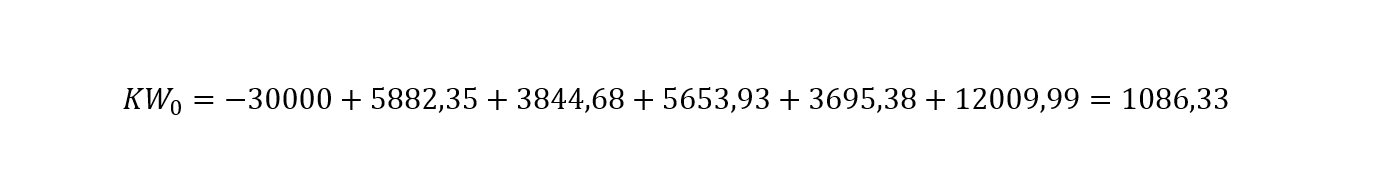

In our example, we obtain a net present value of 1086.33 dollars. But how should this result be assessed?

Interpreting the Net Present Value

If the sum of all present values (also called “earning value“(EV0) is higher than the investment sum, the result is a positive net present value (as in the example given above).

A positive net present value (NPV0 > 0) –1086.33 dollars, for example – shows that the planned investment generates more profit than a bank deposit at the chosen discount interest rate. Such an investment is economically sensible.

If, on the other hand, you receive a negative present current value (NPV0 < 0), the investment is likely to be a loss and you should not make it.

If the net present value amounts to exactly zero, your investment will only generate the discount interest but beyond that no further profit, and thus offers no advantage - from a purely financial perspective - when compared with putting the money in a risk-free savings account.

| Net present value | Assessment | Description |

|---|---|---|

| NPV0 > 0 | Profitable investment | The investment generates more profit than a bank deposit at the chosen discount interest. |

| NPV0 < 0 | Unprofitable investment | The investment generates less profit than a bank deposit at the chosen discount interest. |

| NPV0 = 0 | The investment offers no advantages compared to a low-risk bank deposit. | The investment only generates the discount interest. |

The net present value makes it possible to assess a single investment or to compare several investment opportunities. If you compare the profitability of different investments, the most economically advantageous is the one for which you have determined the highest net present value.

What are the strengths and weaknesses of Net Present Value?

When calculating the NPV according to the method given above, all time intervals for the investment period are considered independently. The NPV method thus counts among the dynamic methods for accounting. Compared to static methods, this offers the advantage of modeling more complex circumstances, for example, different cash flows in the time intervals or a change in the discount interest rate.

The present net value enjoys great popularity, above all due to the relatively simple calculation method. The indicator is unambiguous and leaves no room for interpretation. However, critics question the net present value’s validity.

The net present value method is problematic mainly because of the following issues:

- The calculation of the net present value assumes a perfect capital market.

- In several respects, the calculation is based on subjective presuppositions which have a significant effect on the amount of the net present value.

The net capital value method assumes a highly simplified capital market – among other things, the equalization of debit and credit interest. Tax regulations are not considered either. In practice, these preconditions do not exist. As a consequence, it is an indicator that cannot be readily transferred to real circumstances.

In addition, there’s the risk that entrepreneurs will try to make those unprofitable investments based on false presuppositions look better. Both the discount interest and the cash flow amount are based on projections and are more or less determined arbitrarily if there is insufficient data. All presuppositions of the net present value calculation should therefore be commented on and sufficiently substantiated by (as examples) specific bank offers, industry data or business figures from previous years.

Click here for important legal disclaimers.